Plan ahead with buying a burial plot in advance

Many families choose to benefit by planning ahead and securing positions at today’s prices in a public, community cemetery. This gives them peace of mind knowing that requests will be honoured and family members will be saved from making difficult decisions at an emotional time.

Advantages of planning ahead with the Southern Metropolitan Cemeteries Trust

Securing your plot today offers tangible benefits that reassure both you and your family for the future:

- Financial security against future costs: Fees are locked in upon the deposit being paid, protecting you against future price increases and enabling you to purchase at today's prices.

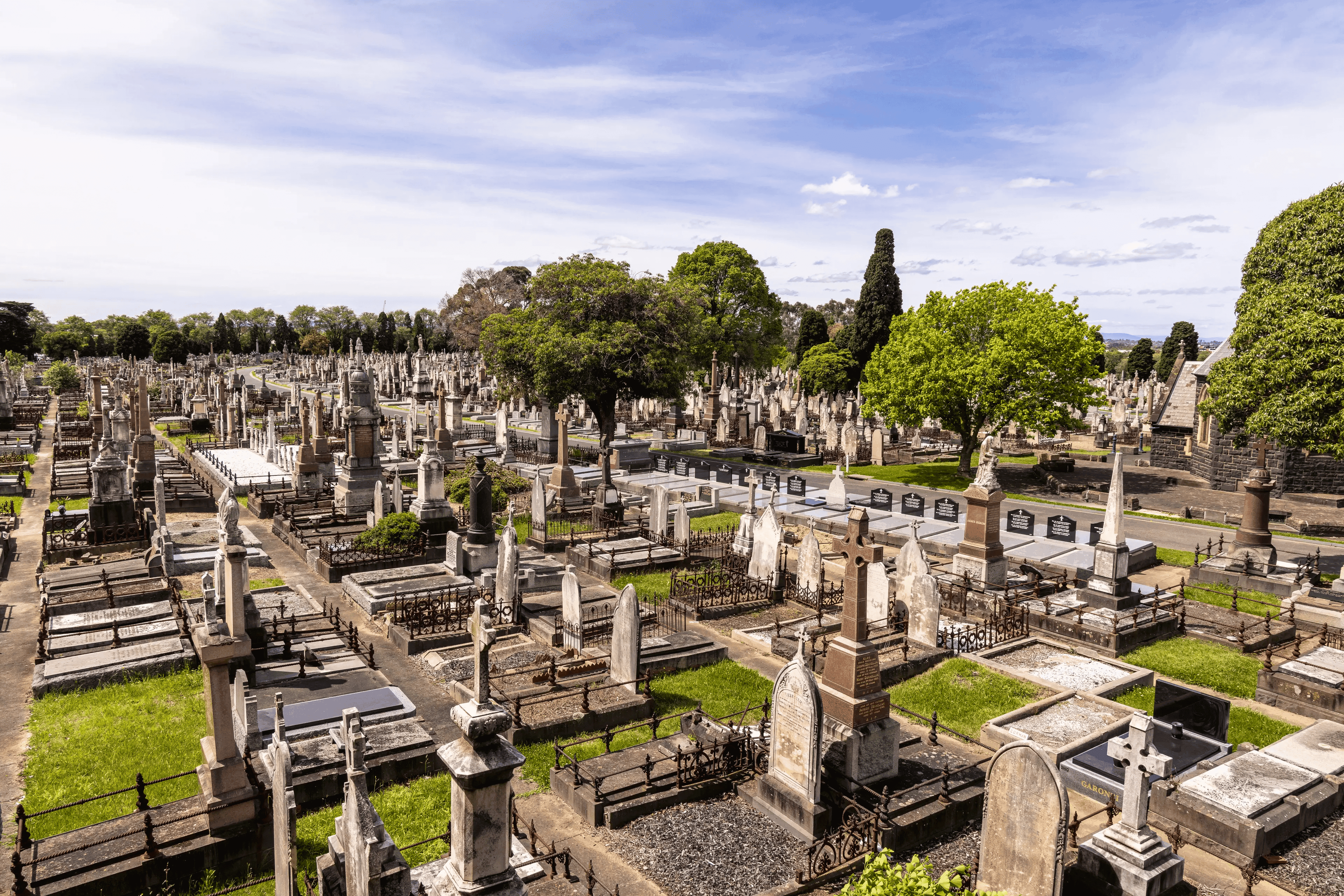

- Secure investment: You can view the wide variety of eleven cemetery locations administered by the Southern Metropolitan Cemeteries Trust. Your funds are securely invested in an organization that has been serving the community since 1852.

- Protection against financial burden: When decisions are made and paid for in advance, there is nothing more to pay and no ongoing fees for your loved ones.

- Secure specific placement: Purchasing ahead secures specific locations, ensuring memorial areas of family members can be positioned together. This offers greater flexibility when choosing the right cemetery.

- Wishes are honoured: Key decisions are accurately recorded to ensure your wishes are carried out and family members are reassured they are doing what you wanted.

- Flexible payment terms: You also have the option of purchasing your burial plots now with interest-free, extended payment terms available.

- Pension considerations: Cemetery plots are not counted as assets and therefore do not impact pension payments.

- Refund option: You have the ability to cancel in the future, if required, and receive a refund. Refunds are based on the current day value if you cancel in 10 years' time, the refund reflects that time's price.

Beware of alternative pre-planning options

If you have considered alternative ways of pre-paying funeral expenses, it is important to ensure that you thoroughly understand the terms of the product you are receiving.

Risks associated with alternative pre-paid funeral plans

It is important to understand the following risks associated with some alternative plans:

- Unfixed prices: Some providers allow you to make small regular payments over time, but the price is often not fixed until the last payment is made, exposing you to inflation risk.

- Refund limitations: Only some pre-paid funeral plans offered by funeral directors offer a refund if you wish to cancel.

- Funeral bonds: Funeral Bonds offered by Friendly Societies and Life Insurance Companies may attract annual fees, which can vary. Also, the money invested can only be used to cover your funeral and cannot be accessed earlier or for any other reason.

Risks associated with funeral insurance

Beware of the fine print with funeral insurance, given the following conditions:

- Limited early coverage: During the first 12 or 24 months, you are usually only covered for accidental death.

- Increasing premiums: The older you are, the higher the premium you will be charged.

- Forfeiture risk: Missing a premium payment will mean that coverage is lost, and all past premiums paid are forfeited.

- Cost vs. payout: For a typical contract (age 60 to age 85) with a $15,000 payout, premiums can amount to approximately $54,593. This often exceeds the actual cost of one funeral.

Comparing the Alternatives

Frequently asked questions on pre-purchasing

Recommended

10 steps to planning a funeral

This step-by-step guide, created by our Customer Care team, answers common questions families ask when planning a funeral.

Funeral planning resources and guides

Preparing for end-of-life decisions brings peace of mind. These resources can help you take the first step.

Financial support for funeral planning

We encourage you to explore what Australian Government welfare options are available if you are facing financial hardship.